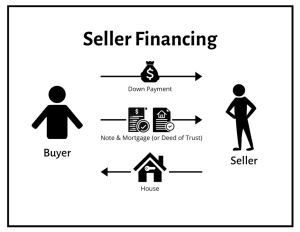

Safe Seller Financing Tips

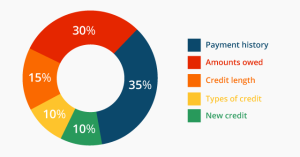

It’s a tough time to sell a house. Hoping to stand out from the crowd, sellers are advertising “Owner Will Finance!” Accepting payments over time provides buyers an alternative to bank financing. Of course sellers don’t want to trade a house that won’t sell for a buyer that won’t pay. Before you agree to “Be the Bank” read these 7 Tips For Safe Seller Financing! Tip #1 – Review the Buyer’s Credit How buyers have paid bills in the past is